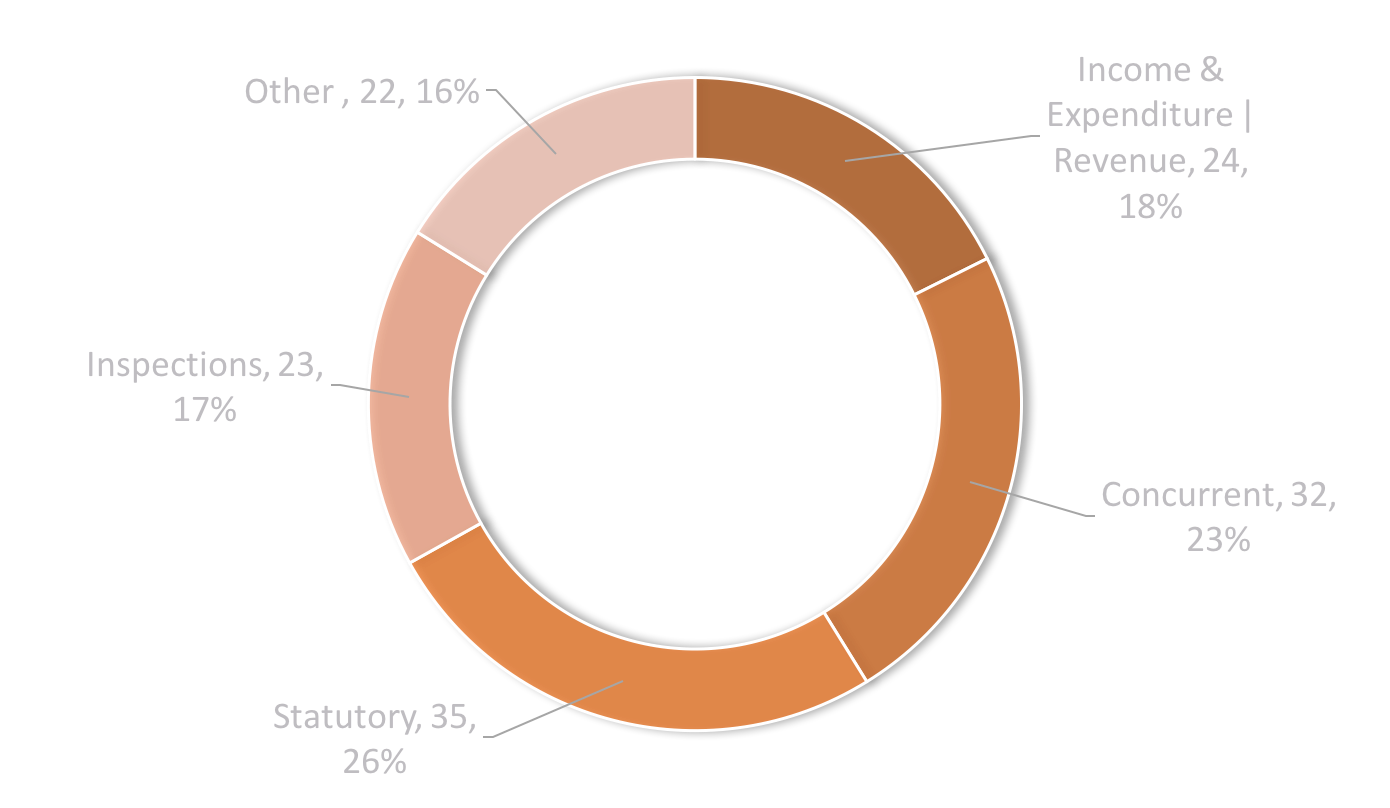

We regularly interact with our clients to ensure adherence to statutory and regulatory requirements, including disclosure norms and provide constructive, value-added feedback. Bharat Parikh & Associates boasts extensive experience in the following types of Audits.

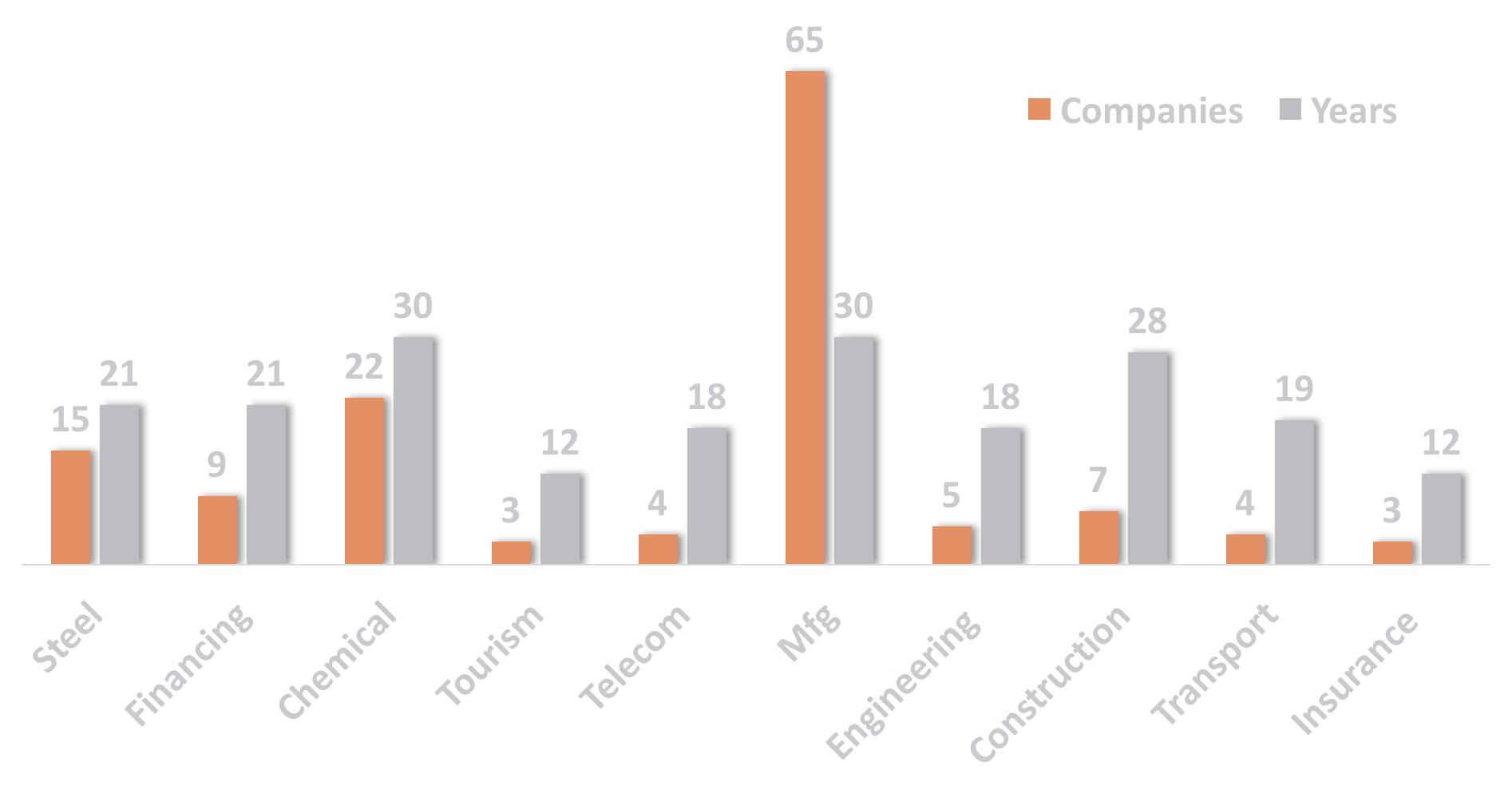

We boast an extensive portfolio of audit expertise spanning across all major private and public sectors. The portfolio also covers Government entities. Over the years, we've developed and honed the necessary skills, tools, tribal know-how and relationships specific to each of the industry sectors to truly empower you - our client, to chase your dreams.

Banks form the most important channel in our audit portfolio. Our experience with bank audits logs back all the way to the establishment of the company. Concurrent and Statutory audits are quite famous with banks. Credit audit, Independent audit and Stock audits are requested occasionally as well.

Trusted by:

- State Bank of India (SBI)

- Bank of India

- Bank of Baroda

- Indian Bank

- Union Bank

Working with Bharat Parikh & Associates was very easy. The staff was super friendly.

We offer tax planning for optimizing the overall tax burden, reviewing business transactions and assisting with contract structuring, risk analysis and mitigation strategy viz. EPC contracts, change

in ownership / shareholding pattern, secondment arrangements etc.

We provide specialized advice on the international aspects of tax laws and international tax treaties. Also boast expertise in international taxation and in handling transnational company

affairs.

We assist in devising the appropriate transfer pricing strategy, while balancing opportunity and risk management, weighing effective tax-rate optimizations against fiscal-authority challenges and the costs of compliance.

Through our pan-India presence, we assist in regulatory compliance as well as advisory on State Value Added Tax (VAT), Service tax, Excise Duty, Customs Duty, and various other State and local body taxes. We carry out impact analysis of proposed Goods & Services Tax (GST) on your business to help you prepare for the new environment.

We represent our clients before tax and appellate authorities. We also assist in obtaining lowered 'Tax Withholding Applications', 'No Objection' and Income tax clearance certificates.

A Due Diligence exercise comprises of certain agreed upon procedures to assess an entity from commercial, financial, tax and legal standpoints. Beside accounting issues, an exercise of this effect also evaluates a spectrum of tax and regulatory issues such us exchange control, income taxes, indirect taxes and capital market regulations. The expiration ‘due diligence’ is not define by any statute, nor is there any legal binding to carry out the same; on the contrary, it is a creation of conventional practices.